Life Settlement Investments

What is a Life Settlement?

A Life Settlement is the legal sale of a life insurance policy from the policy owner to an investor. Every year $200 Billion in Life Insurance Benefit is expected to lapse. That is Billions of dollars that the policy owners are allowing to go to ZERO. Instead of allowing a policy to go to zero a policy holder should look at offering the policy to investors as a Life Settlement.

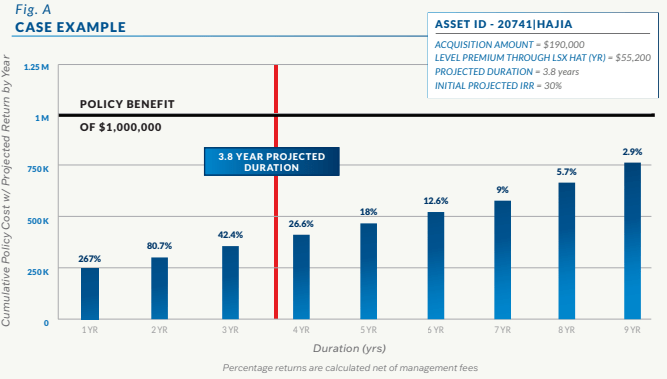

Example Life Settlement Investment

In this example you can see that our AI generated Life Expectancy(LE) is 3.8 years. If the policy pays earlier then a higher return is expected. If a policy pays after the LE then a lower return is expected but the change in IRR is incrementally smaller each year.

This policy illustrates a few concepts. This policy is a $1M policy that was acquired for $190,000(Investment dollars). The investor pays the yearly premiums to ensure that the policy never lapses and in this case they are $55,200 yearly. The projected LE is 3.8 years with an initial IRR of 30%. You can see that LE has a dramatic impact in IRR in the early years but even after 7 years the investment would still return 9% AFTER MANAGEMENT FEES.

Where are policies sourced?

Policies are sourced primarily from the secondary market. This means a policy owner and their broker have decided to sell the policy and have put it on the market for quotes. With relationships in all 50 states with closing providers we review close to $5 Billion in policy face value each year. This scale allows us to bid on the policies with the returns our investors are looking for.

What makes us better at managing Life Settlement Investments?

Our process and technology. Over the past decade decade we have developed relationships within the industry to give us access to a wide variety of policies to choose from. This choice allows us to build policy pools to meet our investor needs. Our AI based technology also allows us to have more accurate Life Expectancy(LE’s) estimates which greatly affects the IRR’s we are able to generate. Last year we reviewed and priced almost $5B in policy value but acquired $60M for our investors.

Why are pooled investments better than individual policies?

One of the keys and most important points is the ability to invest in policy pools. Most investors in Life Settlements started by buying individual policies. These came with a risk that the policy payout would occur many years after the estimates when the policy was purchased. This would cause the investment to vastly underperform the initial estimates. With the pooling capability we spread a single investment across multiple policies at a time to reduce the impact any one policy will have on returns. Traditionally the amount of investment dollars required to purchase multiple policies would price many investors out. Pools allow the same investment to now be spread across multiple policies thereby reducing the return risk while not requiring any increase in investment dollars.

- Pooled investment eliminate return risk from a single policy

- Stable and more predictable returns without an increase in investment dollars.

What do we offer our investors?

- Access to a secure digital valut containing all the investment details including the Financials, Offering an Formation documents, tax information and individual policy data on pool policies.

- Turnkey Service: All legal, bookeeping, accounting, tax and policy management

- Annual financial and health updates including period LE estimates on policies.

- Distributions within 30 days when a policy in the investment pool matures.

- Pooled Investments to spread your investment amongst more policies.

Risk Disclosures

Disclaimer:

This document is provided for the recipient’s internal use only. The information contained herein is proprietary and confidential to LSX Capital Management LLC (“the Company”), and may not be disclosed to third parties or duplicated. This document is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. An investment in an entity managed by the Company may only be made pursuant to definitive offering documents, including, but not limited, to an Investment and Subscription Letter and related documents (the “Offering Documents”). Any person subscribing for such an investment must be able to bear the risks described in the “Risk Factors” in the Offering Documents, and must meet certain suitability requirements. Although the information provided herein has been obtained from sources which the Company believes to be reliable, such information may be incomplete or condensed, and no representation, express or implied, can be made as to its accuracy. The information is subject to change without notice and the Company has no obligation to update the recipient of this document.

Forward-Looking Statement Disclosure

Certain information contained in this document constitutes “forward-looking statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology, such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “can,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction,” “identified” or the negative versions of these words or other comparable words thereof. These may include LSXCM’s financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed investments. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. These factors should not be construed as exhaustive and should be read in conjunction with the Risk Factors and other cautionary statements that are included in the Offering Documents.