Life Settlement Investment – First Track LLC

Projected Financials:

Proj. IRR: 16-18%

Equity Mult.: 1.75x

Proj. Duration: ~7 Years

- $50,000 Minimum Investment

- Annual Capital Calls capped at 30% of Initial Investment

- Projected IRR’s are net of all Management Fees

- Accredited Investor

Investment Features:

- Non-correlated to Finacial Markets

- Fixed Future Investment Value

- Estimated Multiple on total invested caliptal of 1.75x

- Total=Initial Investment + Capital Calls

- Known Cash Flows

- Diversification

- Perpetual Opportunity

- Participate in multiple portfolios

- Max 30% Cap Calls of initial investment

- IRR’s are net Management Fees

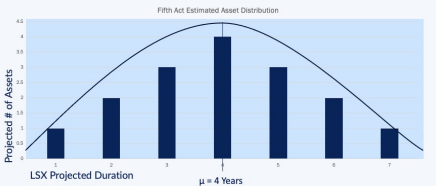

Asset Distribution:

Policy maturities are projected to follow a standard bell curve, with the mean duration projected at approximately 4 years. Projected acquisition of ≥ 14 assets within the portfolio.

Contact Us To Learn More.

Important Disclosure Information and Risk Factors: This document is provided for the recipient’s internal use only. The information contained herein is proprietary and confidential to Fifth Act LLC (the “Company”), managed by LSX Capital Management LLC (“LSXCM”), and may not be disclosed to third parties or duplicated. This document is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. An investment in the Company may only be made pursuant to definitive offering documents, including, but not limited, to an Investment and Subscription Letter and related documents (the “Offering Documents”). Any person subscribing for an investment in the Company must be able to bear the risks described in the “Risk Factors” in the Offering Documents, and must meet the Company’s suitability requirements. Although the information provided herein has been obtained from sources which the Company believes to be reliable, such information may be incomplete or condensed, and no guarantee can be made as to its accuracy. The information is subject to change without notice and the Company has no obligation to update the recipient of this document.

Forward-Looking Statement Disclosure: Certain information contained in this document constitutes “forward-looking statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology, such as “projected,” “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “can,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction,” “identified” or the negative versions of these words or other comparable words thereof. These may include LSXCM’s financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed investments. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. These factors should not be construed as exhaustive and should be read in conjunction with the Risk Factors and other cautionary statements that are included in the Offering Documents.